The question Can we learn from the past?

An exploration of the Keynes Vs Heyak debate hosted at the London School of Economics (LSE) and BBC Radio 4 in July 2011.

The debate was about the contrasting economic theories of the two economic thinkers, and what actions Governments could and did undertake to mitigate the financial crisis of 2008, and if any of those theories and or actions could be applicable to the financial crisis we are entering due to the Covid-19 pandemic.

Introduction

The debate was recorded in July 2011 at the LSE and was chaired by Paul Mason (who was BBC Newsnight economics editor at the time of the recording) and the speakers in attendance were; Professor George Selgin, Professor Lord Skidelsky, Duncan Weldon and Dr Jamie Whyte.

This is the link to the YouTube recording of the debate https://www.youtube.com/watch?v=PLBOKq4On7k

The debate discusses the contrasting economic theories of Friedrich Hayek and John Maynard Keynes, and how those theories were being used to justify the actions that governments undertook to mitigate the impacts of the 2008 global financial crisis.

In this blog, I am not going to critique the debate, (far more learn-ed people me have done so). However, the question I am asking……Is this debate and any of the mitigating ideas and actions applicable in today’s Covid-19 pandemic financial crisis?

The speakers were at the time of the recording;

Professor George Selgin – at the time of recording he was Professor of Economics at The Terry College of Business, University of Georgia, and one of the founders of the Modern Free Banking School, which draws its inspiration from the writings of Hayek on the denationalization of money and choice in currency.

Professor Lord Skidelsky – who at the time of recording was Emeritus Professor of Political Economy at the University of Warwick, and is a Keynes Biographer.

Duncan Weldon former Bank of England economist and at the time of this recording was economics adviser to an international trade union federation.

Dr Jamie Whyte – at the time of the recording he was working for a London-based strategy consulting firm specialising in the financial services industry, as the Head of Research and Publications.

Discussion

The debate is 11/2 hours in length, covering multiple different aspects of the theories and the economic situation in 2011, and therefore I will only be discussing the questions and answers where there is relevance to today’s economic situation.

The debate starts with opening statements from Professor Lord Skidelsky promoting Keynesian economic theories and with Dr Jamie Whyte responding with the economic theories of Hayek.

Both of the opening statements are overviews of the beliefs and theories of Keynes and Heyak, and are indicative of the limited interaction between them, and how their theories could and did impact government policies during the great depression of 1929- 1932, the recessions of the 1970s and 1980s.

Lord Sdelsjky opens the debate by explaining Keynes book ‘The General Theory of Employment, Interest and money’ (1936) and was written to explain the American Great depression of 1929 to 1932.

Lord Sdelsjky expanded by discussing that in 2011 the economy was flat and that Keynes’ theory suggests that governments need to spend money by investing in bodies or public works that would create jobs, therefore reviving the economy but this will create a deficit.

Lord Sdelsjky then compares Hayek’s theory that ‘booms’ in the economy are created allowing too much credit (that could be used for investment), which in turn leads to the ‘bust’. Lord Sdelsjky quoting Hayek “the boom was the illusion the slump is the reality” and these slumps must be allowed to run their course, therefore enabling the bad credit and investments to be cut. Lord Sdelsjky infers that the theory is a ‘do-nothing’ theory.

Dr Jamie Whyte responds with his opening statement that “there are no atheists in the trenches”, and then applies that to economics – ‘that there are no Hayekians in a recession’. Dr Jamie Whyte continues by indicating that the last time Keynesian policies were used in the 1970s and that they failed then, suggesting that the USA state interfered with the economy by federal reserve price-fixing in 2008 which in turn led to the financial crisis.

Dr Jamie Whyte continues as humans, we can be irrational, subjective and personally invested – when faced with companies that are failing we will not invest in them. But because Keynesian policies need governments to invest, it inevitably means we as the taxpayers become responsible for that investment, we become beholden to the civil servants that are making the monitory choices and telling us that we have to pay back the credit that is lent to the failing organisations.

Dr Jamie Whyte discusses Cristina Roma (a member of the Council for Economic advisors for President Obama) as an example of the above. She designed the stimulus package that was promised to increase GDP, with every $1.00 the treasury spent it would get $1.57 back – keeping unemployment to 8%, however, the stimulus did not return the expected GDP and unemployment ran at 10%

The host (Paul Mason) starts the debate by asking Lord Sdelsjky “What was special about the man [Keynes] himself?”, to which Lord Sdelsjky replies that the economics profession at the time [the 1920s] was very much against state interference in economies around the world. However, economies had become volatile, and economists were unable to explain these fluctuations. Keynes said that these fluctuations should not be suffered and that governments should step in to mitigate them.

The host (Paul Mason) then asks Professor George Selgin about the ‘Do nothing theory’ or a ‘liquidator’ label. Professor George Selgin agrees with the label of ‘Liquidator’ but disagrees with the label of a ‘Do nothing economist’ by stating that Hayek was in some agreement with Keynes in the 1932-33 great depression that monetary spending by the governments should be continued, enabling a sound monetary system but also states that the investment should not cause another boom (with the inevitable and consequential ‘bust’).

The floor is then opened to audience questions, and it is here that the debate turns from discussing the theories to actual events in the British and global economies.

Audience Question

The first question was put to Lord Sdelsjky – Does increasing deficits have any effect on interest rates and monetary policy? and Could austerity create a stimulus reduction in interest rates generally?

Lord Sdelsjky in his answer, he states that there is no evidence to state that austerity produces recovery and disagrees with the point that deficits ‘crowd out’ public spending by increasing interest rates.

The question is then put to Dr Jamie Whyte who responded by saying that monetary stability (Neutrality) is gained when money is not redirected from one area to another, as this redirection distorts relative pricing, because the information for the markets to work properly has been removed and so, therefore, Hayek would be against state intervention.

Lord Sdelsjky responds by saying that the important component is that the money is spent and that therefore any printed money (known today as Quantitive Easing, QA), is spent. Where this money is not spent but hoarded – this is considered to be a ‘Liquidity Trap’

Professor George Selgin responds to Lord Sdelsjky by expressing that Keynes’ theory does not address the boom, but just the bust; whereas Heyaks theory addresses the boom and the bust, urging that booms should be constrained therefore reducing the possibility of a bust, and thus maintaining monitory neutrality.

Audience Question

With the UK Government bailing out the banks in 2008, does this saddle us and future generations with insurmountable debt?

Duncan Weldon responded to the question through 3 points – Point 1; Government took on debts, but they have also taken on the assets of the banks they have bailed out. Point 2; if the banks had been allowed to fail, then cash machines would have stopped working, and then it could have been a far worse economic blow. Point 3; The banks that were bailed out or purchased have been ‘sat on’, or not changed, and this was not the best idea and could have been handled better.

Professor George Selgin responds by saying that Keynes says it does not matter how QA is spent so ‘digging ditches and filling them in again’ is ok, and by that comparison bailing out the banks to sit on the given money is in the same vein, as digging ditches and filling them in.

My thoughts:- Both speakers make interesting points, and to some extent answer the questions – it is not just the debt that has to be considered, but how that debt is created, the organisations receive the QA monies, what assets are gained, and what is done with these assets.

Audience Question

The stimulus packages implemented in China, (possibly partly due to the regime) were effectively spent on infrastructure where it had a dramatic effect. whereIn comparison the (possibly hindered) USA strategy was not so effective…….

Lord Sdelsjky agreed with the sentiment concluding that slower-growing economies have austerity measure in place, where the faster-growing economies have had large investment strategies.

My thoughts:- The speakers for the Hayekian theories did not answer this question, which is of interest.

Audience Question

What would Keynes and Hayek have done about the Euro crisis?

Professor George Selgin responds by saying that Hayek was not a fan of the single currency, but of adding a hard currency, so people could continue to use the German Mark or the Italian Leiria, but have another currency to use. Duncan Weldon responds that where countries have implemented hard austerity (e.g. Portugal, Spain, Greece, Ireland) the economies have shrunk, deficits have increased, and emergency budgets have been called.

Professor George Selgin rebuts by saying that Hayek would oppose a boom, citing that in 2001 during the Dotcom boom the US federal reserve held down interest rates to stimulate the economy, this created the boom, and then the bust of 2008.

My thoughts:- These responses indicate that investing in the economy results in a faster return to growth and that austerity (which is supported by the Hayekian theory to a point) results in a slower economical recovery.

Paul Mason, (the host), posed another question summarised thus – What would Keynes or Hayek do now [in2011]? and What would they advise western states (the EU, the USA and the UK) to do to get out of the financial crisis?

Professor George Selgin started responding to this by discussing the differences between the construction industry that is suffering and the financial industry that is not. He expressed that Hayek would have said liquify the banks that were insolvent and needed saving by government investments due to the lending or investing they had done.

Professor George Selgin continues that by investing in the banks shows that QA and by implication Kennysian theory has failed because the banks that were invested in have sat on the money and that investment from the US state or the federal exchange has allowed the bankers to remain wealthy while the construction industry is left floundering.

Duncan Weldon responds by saying that Keynes argued against the term ‘Treasury view’ – which was a view held within most advanced economical states. Treasury view was the widely held belief that government spending or investment could not help in a recession, as it would crowd out private spending, therefore making the situation worse.

Duncan Weldon continues, stating that the UK government in 2010 selected by choice cuts in spending, adopting a Hayekian policy, with early indicators showing a growth of 0.2% in the 9 months after the change, however prior to the change Keynesian policy was being used and growth was 2.1%.

My thoughts:- The opening speaker supporting Hayek (Professor George Selgin) offers no real solutions to the economic crisis of 2011, except to identify specific investment errors made by the US government. The Keynesian supporter (Duncan Weldon) does imply that the Hayekian policy being adopted by the UK Government was failing when compared to the Keynesian theories.

Audience Question

Should we not be looking at the northern European countries like Germany that are fairing better through this economic crisis?

Professor George Selgin answers the question by saying that Germany is not using a Keynesian model, Lord Sdelsjky agrees but expands by discussing that Germany has through institutions invested in its infrastructure, however other more northerly European countries have large state sectors, larger taxation burdens, work fewer hours than the USA, but in general attain higher standards of living.

My thoughts:- Lord Sdelsjky raises some interesting points that the Northern EU countries do attain a higher standard of living, although the public has higher tax burdens. The implication being that the USA have a Heyakian policy of little state interference and the Kensian policy of state interference is justified, however, this is an extreme.

Audience Question

What would you do if not prop up the failing banks? Was there any alternative that would still allow for credit to businesses? And if this happens again what would you have done?

Professor George Selgin responds by saying that the Federal Bank (USA) paid banks not to lend money within the domestic market, the host (Paul Mason) asks Duncan Weldon about the ‘zombie banks’(Banks that have been bailed out by the respective governments, but do nothing to pay back the investment), he answers by saying that at every level the economy is in save and pay back debt mode. Professor George Selgin replies that the ‘zombie banks’ should be wound up (liquidated), this would enable governments to invest in good banks, therefore allowing people to move their money to the good banks, (the implication is that the good banks are rewarded for the investments they have made, with new customers and growing financial reserves).

My thoughts:- The logic of liquidating the ‘zombie banks’, and the result that customer will move to safe banks (and the positive impact of this) is undeniable, but would it have saved or mitigated the impacts of the economic crisis? That is probably the most important question, but it is not answered here.

Wrapping up the host (Paul Mason) asks the speakers the following questions –

What would Keynes be saying to President Obama? Lord Sdelsjky replies that the advice would be to set up an infrastructure bank that would get investment going.

What would Hayek be advising David Cameron (UK prime minister at the time)? Professor George Selgin responds that relying on the central banks to maintain monitory stability will only result in the continued boom and bust cycles.

In Conclusion – more questions than answers?

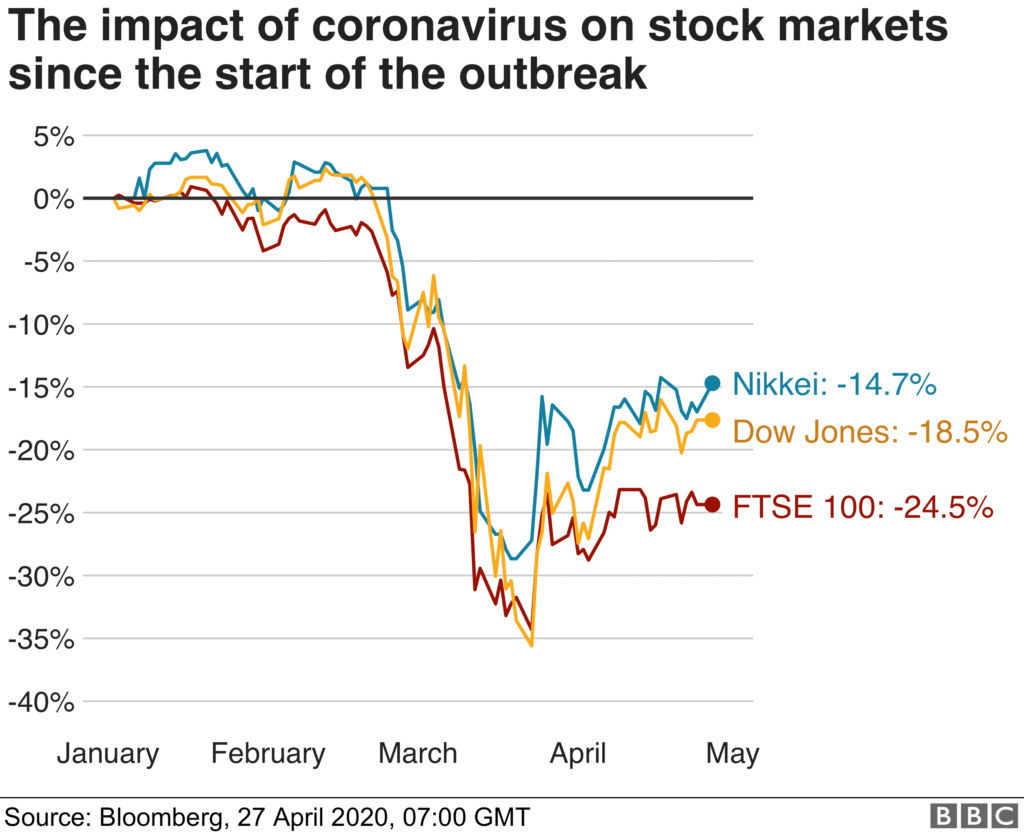

The reason for examining this debate was to see if anything learned from the 2008 recession could be considered useful in today’s economic climate. If any theory or set of actions could mitigate the impacts of the Covid pandemic on the global economies.

Would Hayek have disagreed with the QA and the investments being made into the economies right now? I am not unsure, as this recession is not following a boom, so would Hayeks theories help the global economies grow and avoid a bust? They may do, but will cutting away bad investments or credit help the global economies recover?

Without a doubt there will continue to be many business and organisations that fail because of the impacts of the Covid-19 pandemic, that may be because they have bad debts, or high operating costs, low income, or are unable to adjust to the current temporary (or not) situation.

Hayekian theory looks to me to be a long game, regulating the growth, maintaining a steady incremental growth, one that can be sustained, and this, in theory, could mitigate the bust, it may not stop a bust from happening, but the bust may be smaller because the growth (or the boom) has been smaller.

However there is one barrier to this long game theory, and that is governments.

Governments tend to be short-sighted looking to create a boom to satisfy the voter.

In opposition, the Keynesian theory does not address the growth or the boom but does address the bust, so could this theory be considered to be one-sided? Could this recession be considered a bust? Could implementing the Keynesian theory address the global economic impacts being suffered now? Many governments are investing in their own economies now, but what will they do after? Will austerity come back?

So in answer to the initial question I have asked – Can these theories help us out of this recession? Well, this is not a bust recession, but an externally influenced bust, so will Kensiyian strategies help us out? I think they could, however investing in the economy, only then cut interest rates and impose austerity will not facilitate the recovery. Combining the Kensian recovery with the Heyakian restrained growth after the recovery could mitigate a financially lead bust.

What we do know is that this global economic situation is unprecedented and due to the nature of the external factors continuing for some time and whereas both Keynes and Hayekian theories may have options to offer, we may be needing to look at new ideas in economics to survive the present situation.